Biweekly mortgage calculator use cases

Investopedia.com defines "biweekly mortgage" as:

A mortgage with principal and interest payments due every two weeks.

The advantage of biweekly mortgage is that it is an effective way to reduce:

- interest cost

- the length of the mortgage

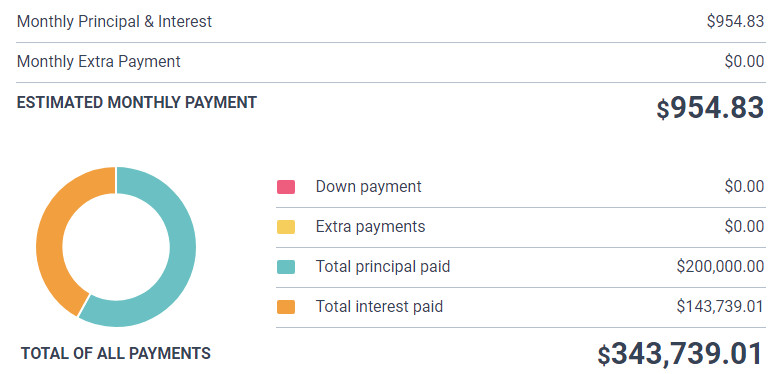

Suppose you want to take a house in a regular mortgage with payment once a month. We will use this mortgage calculator to make the calculation. With a house value of $200,000 a payment period of 30 years and a rate of 4%, a monthly payment is $954.83 The amount of interest that you pay for 30 years is $143,739.01.

Now we will calculate the same values for the biweekly mortgage using the calculator above.

We'll see that the amount of interest has decreased, the payment term has decreased. Thus, you will pay the mortgage for 4 years less (26 years instead of 30 years) and will be able to save $22,553.31 thanks to biweekly mortgage payments.

Refer to the table below to see a comparison of both types of mortgages.

| Biweekly mortgage | Monthly mortgage | |

|---|---|---|

| Payment (principal, interest) | $477.42 | $954.83 |

| Monthly cost | $1,034.40 | $954.83 |

| Years to repay | 26 years | 30 years |

| Total interest paid | $121,185.70 | $143,739.01 |

| Total interest saving | $22,553.31 | - |

| Total of all payments | $321,185.70 | $343,739.01 |

How biweekly mortgage payments work?

The benefit of biweekly mortgage is achieved due to the fact that in the year 52 weeks, respectively, in the year there will be 26 payments. As a result, one additional payment is received per year, which significantly affects the mortgage's term and interest.

Also, you can pay down your mortgage early. Twelve expert tips to pay down your mortgage in 10 years or less. (link)

Biweekly mortgage drawbacks

On clark.com Andy Prescott wrote an article “Why you don’t need the biweekly mortgage plan”.

He claims that unfortunately often the biweekly mortgage plan does not work as it should. In fact, when mortgage companies take the first two-week payment from you, they do not apply it to the principal, they do not do anything. They keep this payment for two weeks and only after they receive a full monthly payment they apply it to your loan. This approach allows them to minimize their losses from the biweekly mortgage plan.

Talk to your mortgage company and find out how the calculations of biweekly mortgage payments will be made.

Another important factor to pay attention to is service fees. According to wikipedia:

Some mortgage companies charge large amounts of service fees to convert a mortgage to a Biweekly payment plan.

This can reduce the benefits of a biweekly mortgage.

Use mortgage calculator to find out what is better - biweekly mortgage payments vs monthly payments

If you still decided to use the biweekly mortgage program, we advise you to pay attention to the regular mortgage with one extra payment each year.

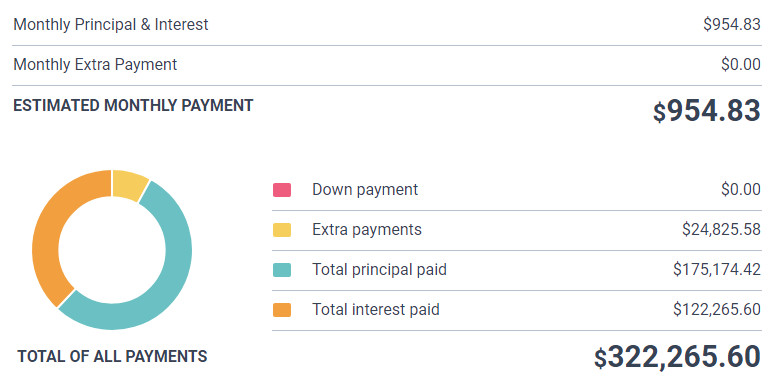

You can this mortgage calculator with extra payment to estimate the payments. With one extra payment each year, the total interest paid is $122,265.60, the repayment period is also decreased from 30 years to 26 years.

At first glance, everything is the same, but making extra payments turns out to be a pretty good idea because:

- When using biweekly mortgage payments, it happens that you have to pay 3 payments per calendar month instead of 2. This can be a surprise for you and damage the family budget.

- You could set up a new savings account and pay on it every month an amount that at the end of the year will amount to 13-th extra payment of your mortgage payments.

Thus, you will receive additional profit by accruing interest on your savings account during the year. To calculate the amount that will need to be paid each month - take your monthly mortgage payment and divide it by 12 (the number of months in the year). In our example, the calculations will be as follows: $954.83 / 12 = $79.57

This mortgage calculator has only been designed to give a useful general indication of costs. It's important you always get a specific quote from the lender and double-check the price yourself before acting on the information.